Avoiding Dual Axis Charts, Part 3

PolicyViz Newsletter #36

Hi all,

I've written before about how dual axis charts can mislead and confuse (here and here), but I’m adding another post to the series because recently the US Department of Agriculture Economic Research Service (ERS) published a chart that clearly shows how these graphs can be confusing.

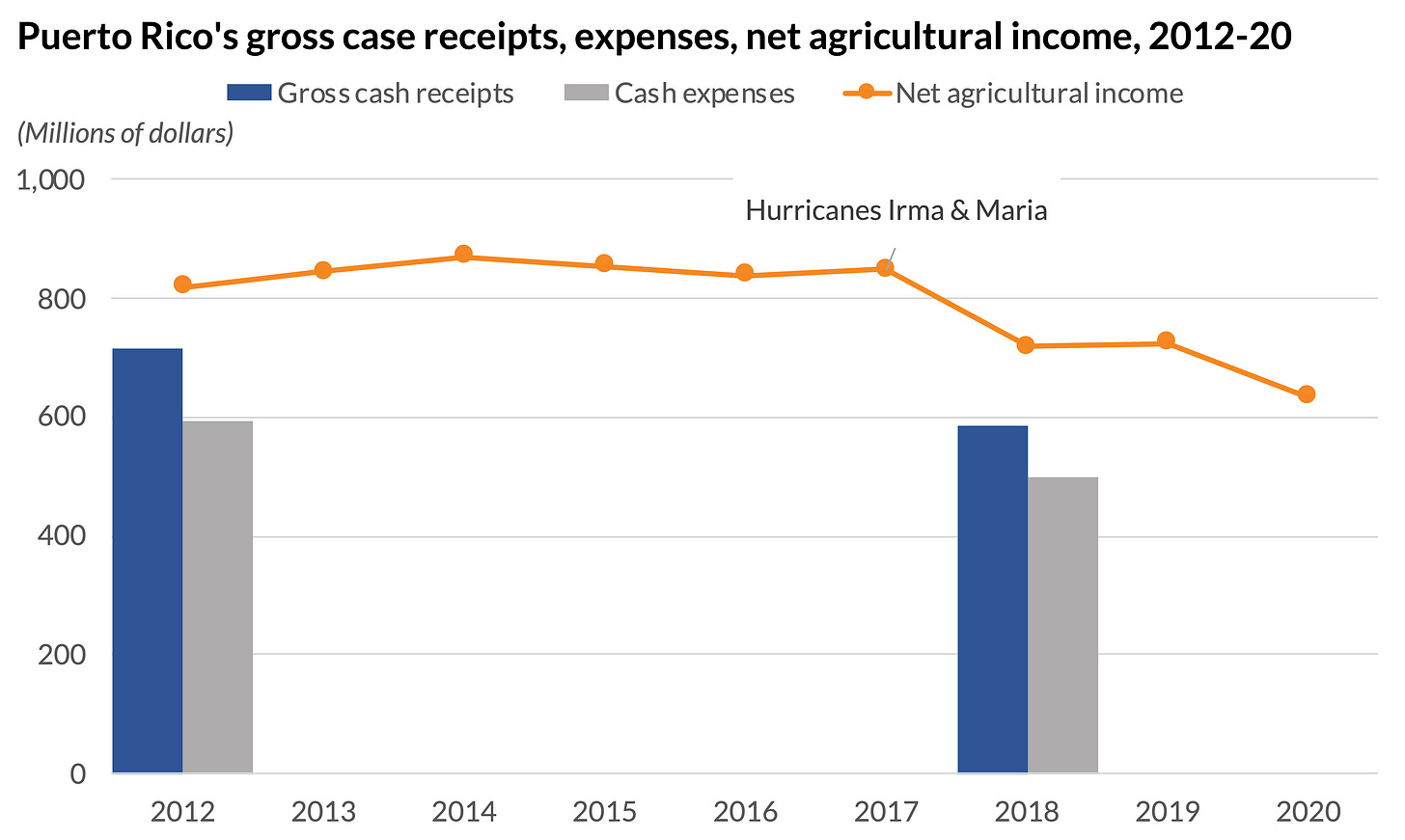

This ERS dual axis chart shows gross cash receipts, cash expenses, and net agricultural income in Puerto Rico from 2012-2020. Cash receipts and expenses are shown as vertical bars and tagged to the left axis and income is shown as an area chart and tagged to the right axis.

Look quickly. Which is higher in 2012: receipts, expenses, or income?

At a glance, you might think that receipts were higher in 2012, with income higher in all other years. But when this graph is recreated using a single axis (I eyeballed the numbers, so don’t hold me to the precise values), it tells a very different story.

Because the left vertical axis starts at $400 million, it distorts the differences between the bars and the bars’ values relative to the area chart. But that’s only part of the problem. Even starting the single axis version at $400 million doesn’t show the same relationship as the dual axis version.

That’s because there’s an additional problem with this graph, hidden in the chart note: “Gross cash receipts and cash expenses for 2012 are adjusted for inflation with base year of 2018. Net agricultural income has not been adjusted for inflation.” In other words, the receipts and expenses values are adjusted for inflation, but the income values are not. Even though both of the original axes are measured in millions of dollars, the dollar values aren’t actually equivalent.

The full report goes into more detail (I have bolded the phrases that are most important for this discussion).

Cash expenses for Puerto Rican farms decreased between 2012 and 2018 by 16 percent, from $594 million to $500 million. After adjusting gross cash income values downward to be comparable to cash expense values in terms of the number of reporting farms, calculated net farm income reflects the rise in revenues and decline in cash expenses, increasing from $15.5 million in 2012 to $21.0 million in 2018. That is, net farm income rose 36 percent because of both the decrease in the number of farms reporting and the increase in Government payments.

To depict how farm revenues—and therefore gross cash farm income—may have fluctuated in the years between Census of Agriculture reports, figure 5 combines data sources to show net agricultural income for 2012 through 2018. The $101 million decline in net income indicated by the solid area spanning from 2012 to 2020 in figure 5 reflects the net agricultural income reported by the Puerto Rico Planning Board. It shows a less dramatic decrease than the $133 million decline in farm cash receipts (blue bars), based on USDA, NASS survey data collected for the Census of Agriculture.

Notice the focus on change in the boldface text, something that can only be done once the data have been adjusted for inflation. Even if the analysis intended to show a decomposition in net income, because the report includes—and compares—changes in income (both percent and level), all dollar values should have been adjusted for inflation. By not doing so, the chart essentially compares apples to oranges.

In this case, because the time series is not so long, adjusting for inflation isn’t hugely important, but you can see some differences in the nominal (orange) and real (blue) series in the next graph.

Once again, we can see how dual axis charts are problematic. They can confuse, mislead, and distort the data. In this particular case, a dual axis chart wasn’t even necessary, and it just made the data harder to read. But the lack of comparable adjustments to the data, which the dual axis chart initially masked, makes the presentation even more problematic.

PolicyViz at Home 🏡

I’m currently at the Tableau Conference in Las Vegas! I got here early yesterday morning—well, early Vegas time, but afternoon Virginia time—and spent a bunch of time just walking around (and, yes, doing some gambling). I’m excited to see the sights here, meet some Tableau peeps (some, for the first time in person), and learn some Tableau tips n’ tricks. I’ll be speaking today (Tuesday) on my equity and dataviz work.

PolicyViz Podcast with Jeremy Ney

Jeremy is the author of American Inequality, a biweekly newsletter that uses data visualization to highlight U.S. inequality topics and to drive change in communities. His work has been published in TIME, Bloomberg, and the LA Times. He was a dual-degree masters student at MIT Sloan and the Harvard Kennedy School and was formerly a macro policy strategist at the Federal Reserve. He now works at Google and lives in Brooklyn.

Things I’m Reading & Watching

Books

Poverty, By America by Matthew Desmond

Making with Data by Sam Huron et al.

Science Communication in Crisis by Christopher Reddy

Articles

Chart Reader: Accessible Visualization Experiences Designed with Screen Reader Users by Thompson et al.

Colour as a Gestalt: Pop out with basic features and with conjunctions by James Pomerantz

Who DoWe Mean WhenWe Talk About Visualization Novices? by Burns et al.

Blog Posts & Twitter Threads

Visually Accessible Data Visualization by Derek Torsani

Collecting Data About LGBTQI+ and Other Sexual and Gender-Diverse Communities, Center for American Progress

Data Visualizations

Three of the four largest-ever bank failures have happened since March, Washington Post

CPD’s stop-and-frisk tactics leave lasting impact on communities of color, Injustice Watch

Exploiting the legal system, Kontinentalist

Bird Migration Explorer, Audubon Society

TV, Movies, and Miscellaneous

Succession, HBOMax

The Marvelous Mrs. Maisel, Amazon Prime

The Mandalorian (I’m way behind!), Disney+

Note: As an Amazon Associate I earn from qualifying purchases.

Data Visualization in Excel

My latest book is locked in and off to the printers! Data Visualization in Excel: A Guide for Beginners, Intermediates, and Wonks is a true step-by-step book and guides readers through the process of creating better, more effective, and “non-standard” graphs in Microsoft Excel. You can pre-order your copy on Amazon or, if you go to the CRC Press site, you can get 20% off the list price with the coupon code “SMA34.” You can also check out the new webpage I’ve published at PolicyViz, which will eventually include some videos, more resources, and, I’m sure, an errata with typos and corrections.

Sponsor: BlendJet

This week’s episode of the podcast is brought to you by BlendJet. I’m really digging my BlendJet2 portable blender. Easy to use and easy to clean. Be sure to use the promo code policyviz12 to get 12% OFF your order and free 2-day shipping!